APPLE

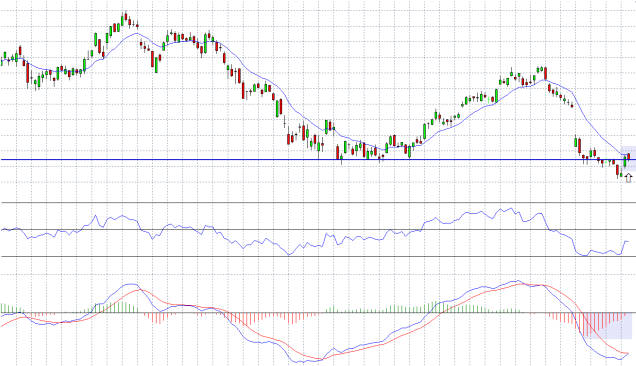

The recent trend of the stock is a downtrend and so far in 2016 it went down by 16%.

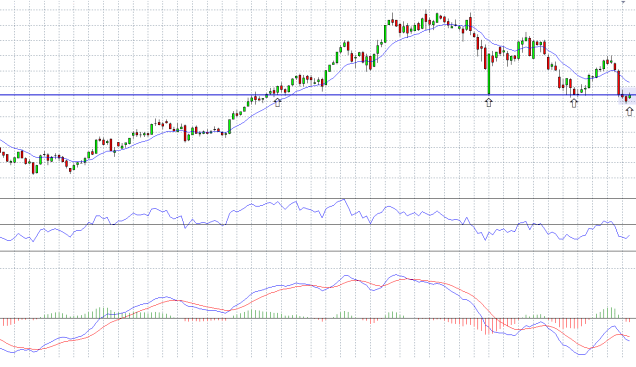

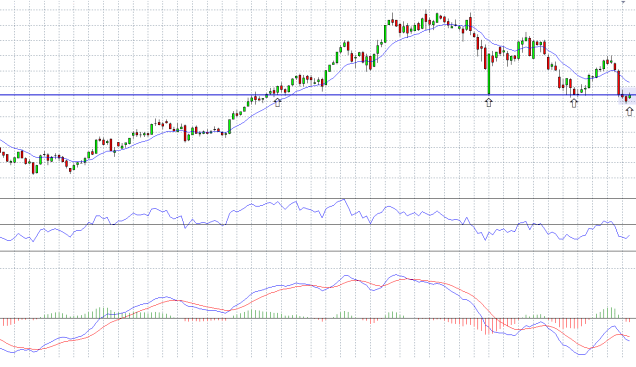

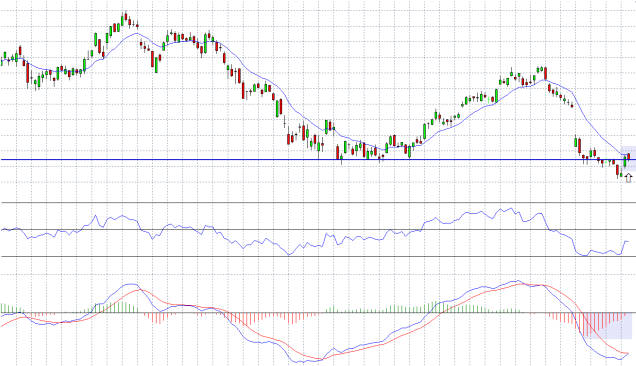

In the last few days the stock have reached a support area, around the level of 93.40, a strong support area as we can see on a weekly chart.

On a daily chart we can see that battle of the last few days around this support area, at first the price of the stock broke down this level but soon after the price went up above it.

The price went up also because of a tailwind which came after Berkshire Hathaway (BRKA), the conglomerate run by Warren Buffett purchased more than 9.8 million shares in Apple during the first quarter (It was Berkshire’s first investment in Apple)

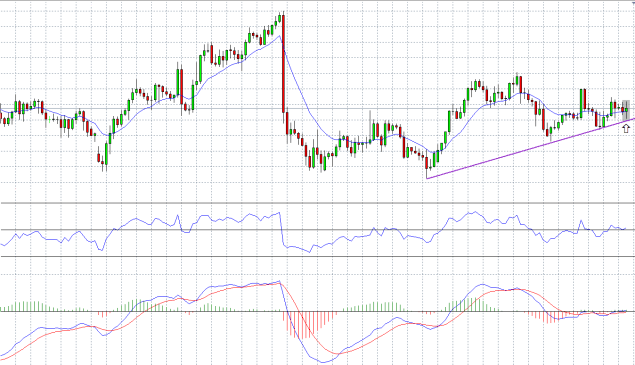

As we can see on the daily chart, beyond that the price is next to a support area, against the last decline of the price of the stock, there is a bullish divergence at the histogram of the MACD.

For Forex traders:

Buy between the levels of : 93.00 – 93.40

Stop loss point : 92.60.

Take profit point : 98.00.

For Binary options traders:

A call option between the levels of : 93.00 – 93.40

Expiry time : The end of May.