EUR/JPY

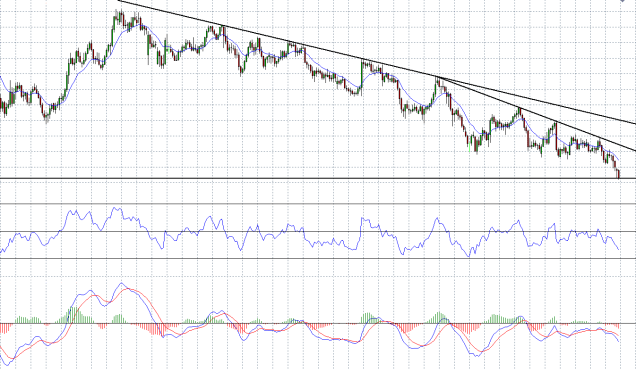

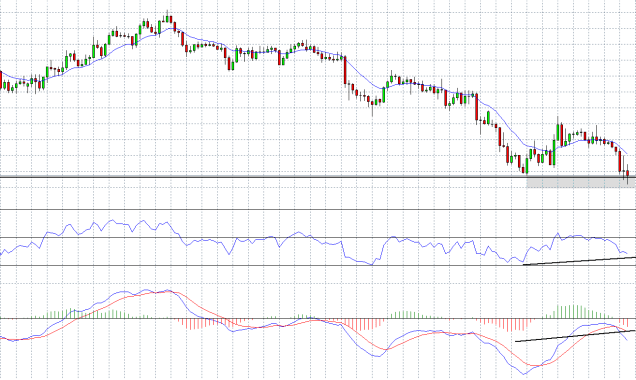

As we can see on the daily chart, the main trend of the pair is a downtrend.

The pair has arrived to a support area, around the level of 119.00.

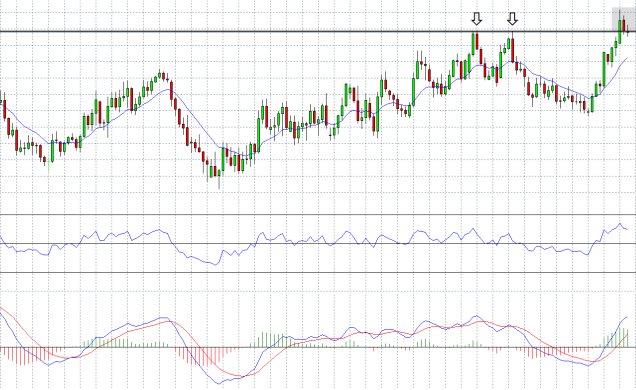

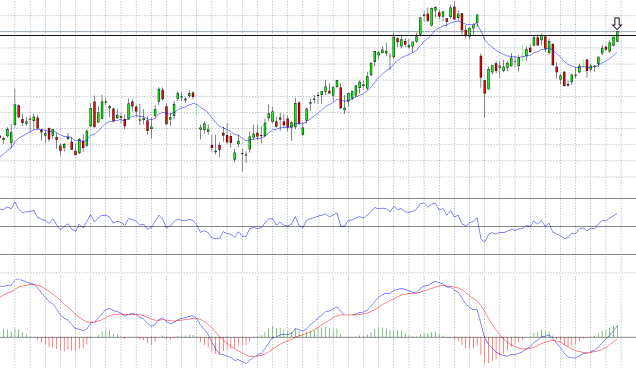

On an hour chart we can see that a double bottom pattern is created, and at the indicators RSI and MACD a bullish divergence is developing also, but this yet to be implemented.

We are waiting for a bullish pattern that will put into effect this divergence, part of a technical upward correction.

For Forex traders:

Buy between the levels of : 118.85 – 119.15.

Stop loss point : 118.50.

Take profit point : 121.00.

For Binary options traders:

A call option between the levels of : 118.85 – 119.15.

Expiry time : June 14, the end of the trading day.