The Asian markets are trading on a mixed note on the last day of the global trading week, after the negative closing on Wall Street yesterday after it became known that US President Donald Trump’s bill to reform the Obama-Kerr was rejected.

Hong Kong stocks fall, Japan and China are rising.

Japan’s Nikkei is trading more than 0.9% today, at the background of the weakening of the Japanese yen against the US dollar.

Japanese exporters whose revenues in dollars lead the gains on the Japan Stock Exchange.

Later in the day, macro data from the US and Europe will be published.

This morning, Wall Street futures are signaling a positive opening for the day.

Trading Opportunity

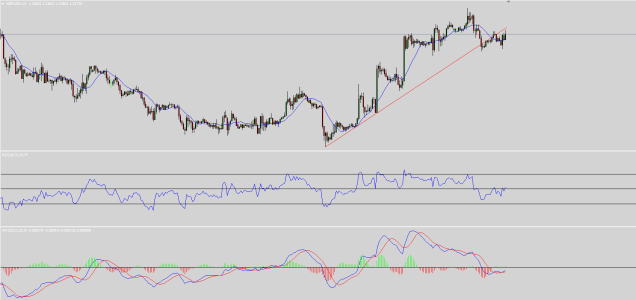

GBP/JPY

On an hour chart, after a small rise, a triangle pattern is developing.

If the pair will go above the upper resistance of the triangle, around the level of 139.30, there would be an opportunity to join in with the rising trend for a short and up to a medium time frame.