The Wall Street stock markets closed yesterday with a slight decline, but completed the fourth consecutive month of increases.

On a monthly summary:

The S&P 500 jumped by 3.7% in February following an increase of 1.8% in January.

The Dow Jones index fell yesterday by 0.1%, but the leaped blue-chip stock index rose in February by 4.9%.

The Nasdaq Composite rose by 3.8% in February, the best month since July.

US economic data released yesterday showed that gross domestic product grew in the fourth quarter was at a slower pace than expected, but the consumer confidence jumped this month to a record 15 years.

The Index of manufacturing activity in the Chicago area jumped sharply in February this year.

The Indices in Asia this morning are rising.

Tokyo Stock Exchange rose by 1.4%, Hong Kong rising by 0.2%, Seoul going up by 0.3% and Shanghai by 0.5%.

China’s manufacturing activity index rose sharply than expected in February following a strong demand, and government incentives.

PMI of China’s manufacturing sector last month climbed to 51.6 points compared to 51.3 in January.

Forex – there is a positive trend for the US dollar, against the Japanese yen is gaining 0.6%, the Euro weakened by 0.2% against the dollar.

Commodities – WTI crude oil is rising by 0.2% to a price level of 54.12 dollars per barrel.

The Gold retreated by 0.9% to a price level of 1243.30 dollars per ounce.

Trading Opportunity

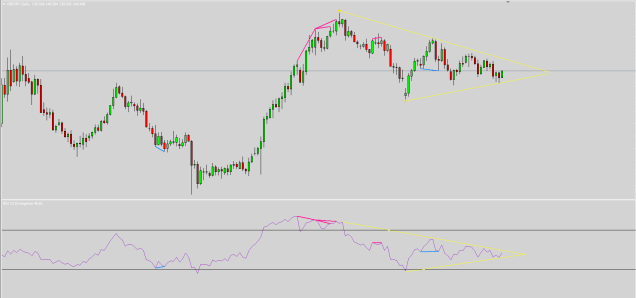

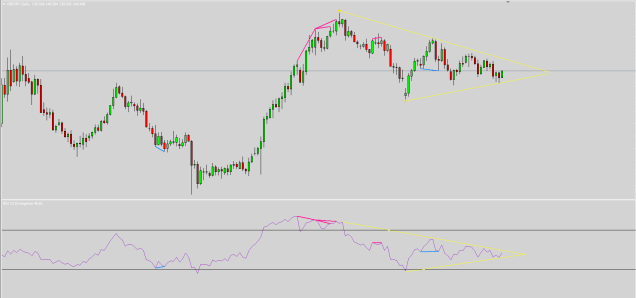

GBP/JPY

On a daily chart the pair is on a rising trend.

A triangle pattern is created, and the tendency is to look when the pair breaks the upper leg of the triangle.

A brake above the level of 142.00 could led us into a trade, to a long term expiry time.