The US wholesale prices climbed sharply than expected in February.

The producer price index (PPI) climbed last month by 0.3% compared to January and well above economists’ forecasts of a 0.1% increase.

The US wholesale prices climbed sharply than expected in February.

The producer price index (PPI) climbed last month by 0.3% compared to January and well above economists’ forecasts of a 0.1% increase.

The trading on Wall Street stock exchanges ended yesterday almost unchanged at the leading indicators.

The Dow Jones Industrial Average fell by 0.1%, the S&P 500 rose by less than a tenth of a percent, and the Nasdaq rose by 0.2%.

The British Parliament approved this morning the operation of Article 50 of the Lisbon Treaty allowing the UK to go out of the EU.

The US dollar getting stronger versus the major currencies.

The dollar strengthened against the Japanese yen by 0.2% to 115.1 yen.

The pound weakened by 0.7% to 1.2132 dollars and the Euro falling by 0.1% to 1.0638 dollars.

Most of the Asian markets are rising today, led by Mumbai which adds 1.6%.

Seoul index increased by 0.7%, Tokyo fell by 0.1%, Hong Kong and Shanghai are unchanged.

Trading Opportunity

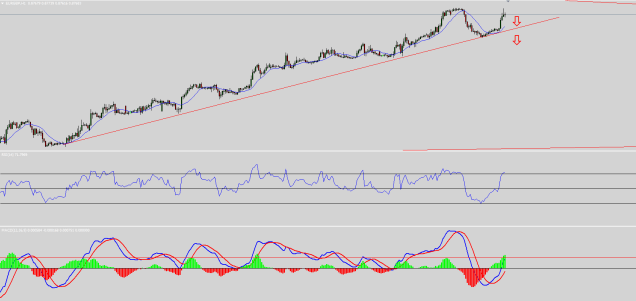

EUR/GBP

After an impressive rise of the Euro against the Pound, on an hour chart the indicator of the RSI is signalling that the pair have reached to an over bought level and that we can try and start looking on a coming decline.

The entry to put trades can go ahead after the pair will broke below the diagonal support line, around the level of 0.8700.

Wall Street stock exchanges trade almost unchanged in the leading indicators.

The Dow Jones Industrial Average falling by 0.1%, the S&P 500 is unchanged, the Nasdaq Composite Index rising by 0.1%.

The futures contracts on Wall Street signalling on stability at the opening of the trading day.

Investors attendant on the flow of essential data to be released this week, mainly the Fed’s interest rate decision on Wednesday.

Since the beginning of March, the oil prices dropped almost by 11%.

Earlier this year, the OPEC countries (Organization of Petroleum Exporting Countries) declared to cut the production in cooperation with Russia, in order to reduce supply to the market and raise prices.

With the announcement of the agreement in November the prices jumped, but in the last two weeks released some data that might indicate that the agreement will not be enough and probably only cause OPEC countries lose market share.

Investors’ attention will focus on two major events this week.

First, the elections to be held on Wednesday in the Netherlands, this time receiving worldwide attention following the popularity of Geert Wilders, head of the far-right party “Freedom Party”.

The elections in the Netherlands will start the season in the European elections – and a victory of Wilders may affect the elections in the entire continent.

Investors are concerned about Wilders’s intention to hold a referendum on separation of Holland from the Euro zone.

On Wednesday there will be also a press conference of the Federal Reserve, and investors expect that following the good figures of the labor market and good economic data from the USA, the bank would announce the first rate hike in 2017. The Bank will also publish its expectations for GDP growth, inflation and future jams.

Goldman Sachs economists anticipate more interest rate hikes in March, September and December.

An interest rate decision expected this week also by the Bank of England, and economists expect it would remain unchanged.

Donald Trump’s administration is expected to disclose this week the budget to 2018. According to estimates, the budget would include an increase of $ 54 billion in military spending, the most significant jump since 2008.

Trading Opportunity:

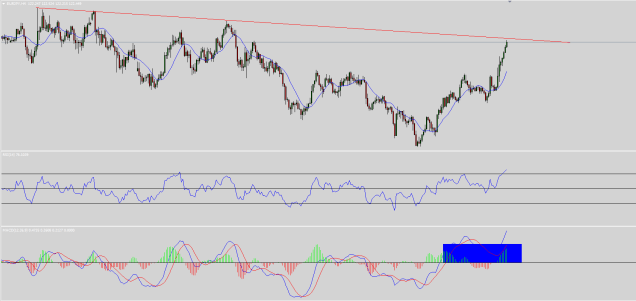

EUR/USD

On 4 hours chart the pair broke above a diagonal resistance line, and now the trend is an up trend.

The up trend also came after last week the pair came to a weekly resistance area which once again was strong enough to hold the pair from going down.

The main tendency is to try and enter call trades for short and medium time frames.

France posted today unflattering data indicating a surprising drop in industrial output in January, against the background of low activity in the manufacturing sector and agriculture.

According to the data, industrial output in France fell by 0.3% in January compared with December.

The low of the Euro rate enables exporters to be more competitive in Germany – which has led to a surge in exports.

However, decreased trade surplus of Germany because the country exports also surged.

According to data of the German Statistical Office, German exports jumped by 2.7% in January compared with December and the imports into the country increased by 3%.

Compared to January 2016, German exports grew 11.8%, and imports increased by 11.7%.

The current account surplus of Germany was lower than forecast and January totaled 12.8 billion Euros, compared with a figure EUR 14.6 billion in January 2016.

Wall Street rose for the first time in four days ahead of the employment report.

Wall Street stock exchanges closed steadily but Dow Jones and the S&P 500 managed to extract for the first increase in four days ahead of the publication of the US employment report later in the day, and after the president of the European Central Bank (ECB) has estimated that there are less chances the the economic outlook will risk the Euro.

The S&P 500 closed up by 0.1% after declining in the previous three trading days. The Dow Jones and the Nasdaq climbed less than 0.1%.

The Crude oil fell below the threshold of 50 dollars a barrel for the first time this year, due to concerns that an increase in US oil production harms the impact of output cuts OPEC countries on prices in global oil markets.

The WTI oil close at 49.28 dollars a barrel, the lowest close since November 29 – after a decline of 2%.

The Asian stock markets trading is conducted today by rising prices, after the fall in the bond market.

Trading Opportunity

EUR/JPY

On 4 hours the pair is reaching a resistance area around the level of 123.00.

A bearish divergence is developing, and if the resistance will hold the pair, we can look to enter with put trades from around that level.

The Euro climbed above the level of 1.06 against the US dollars for the first time since Friday, after the chairman of the European Central Bank (ECB), Mario Draghi, said the bank “has no more sense of urgency” to take additional monetary expansion measures.