The markets on Wall street are expected to open today in stability.

Investor attention will be given as of the beginning of trading in shares of snapchat app, yesterday it was issued at a value of $ 24 billion.

The markets on Wall street are expected to open today in stability.

Investor attention will be given as of the beginning of trading in shares of snapchat app, yesterday it was issued at a value of $ 24 billion.

Euro zone inflation accelerated to the fastest pace since January 2013, providing fresh arguments to those who were calling for an exit from the European Central Bank’s monetary stimulus program.

The consumer prices rose 2 percent in February from a year earlier,

The unemployment rate in the Euro zone remained unchanged at 9.6% – the lowest level since May 2009.

The trading on Asian markets rose on Thursday as investors are encouraged by President Donald Trump’s less combative tone in his first speech to Congress, which sent Wall Street markets to new high, while the growing bets on a U.S. rate hike this month buoyed the dollar.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose by 0.5%, while Japan’s Nikkei rose by 1.3% to a 14-month high.

Wall Street stock markets recorded yesterday the sharpest daily jump since the election victory of Donald Trump and the Dow Jones Industrial Average closed above the 21,000 points for the first time in its history, in view of expectations that the US economy is strong enough to withstand upload another of interest rate soon.

The Dow Jones Industrial Average jumped yesterday by 1.5% and broke for the first time the level of 21,000 points, only 24 trading days after he crossed the threshold of 20,000 points.

The optimism in the US since the beginning of the year was cooled slightly, because according to the “Beige Book” – the periodic report of the Federal Reserve on the state of the US economy published yesterday, the growth in all 12 districts of the Federal Reserve rate continued to be “modest to moderate” which characterized the American economy during most of the past eight years.

The US dollar continues to strengthen in the world after a senior Federal Reserve said on Tuesday that a new interest rate rise is expected soon.

Trading Opportunity:

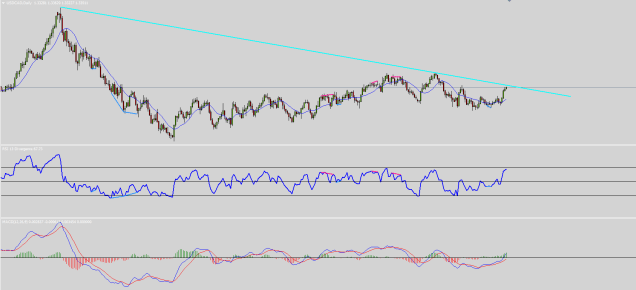

USD/CAD

On a daily chart the pair is getting closer to a descending resistance diagonal line.

The resistance level is around 1.3400.

From there try to schedule entry for decline, and as long as the resistance level isn’t broke up.

At the beginning of the trading day on Wall Street, the Dow Jones Industrial Average jumping by 1.2% and for the first time broke the 21,000 point level, and completes a jump of more than 6.5% this year.

The US inflation climbed in January the his highest level since 2012 and is within reach of the goal of the Federal Reserve, which may increase the probability that the central bank will raise interest rates soon, maybe already this month.

The US consumer spending last month increased by 0.2%, while economists forecast an increase of 0.4%.

The personal income increased by 0.4% in January.

IHS Markit’s final manufacturing Purchasing Managers’ Index for the euro zone rose to 55.4 in February, the highest since April 2011, from January’s 55.2.

It was revised down slightly from the estimate of 55.5 but remained far above the 50 mark denoting growth in activity.

UK PMI manufacturing sector stood in February at 54.6 points, less than the economists’ forecasts to 55.6 points, and after a reading of 55.9 points in January.

The trading on the European stock markets this morning is conducted on a positive trend, after the first speech of President Trump in the US Congress yesterday, as when he promised to reduce taxes for companies and to the middle class.

The FTSE rising by 0.5%, the DAX climbed by 0.8% and the CAC is getting stronger by 0.6%.

The Wall Street stock markets closed yesterday with a slight decline, but completed the fourth consecutive month of increases.

On a monthly summary:

The S&P 500 jumped by 3.7% in February following an increase of 1.8% in January.

The Dow Jones index fell yesterday by 0.1%, but the leaped blue-chip stock index rose in February by 4.9%.

The Nasdaq Composite rose by 3.8% in February, the best month since July.

US economic data released yesterday showed that gross domestic product grew in the fourth quarter was at a slower pace than expected, but the consumer confidence jumped this month to a record 15 years.

The Index of manufacturing activity in the Chicago area jumped sharply in February this year.

The Indices in Asia this morning are rising.

Tokyo Stock Exchange rose by 1.4%, Hong Kong rising by 0.2%, Seoul going up by 0.3% and Shanghai by 0.5%.

China’s manufacturing activity index rose sharply than expected in February following a strong demand, and government incentives.

PMI of China’s manufacturing sector last month climbed to 51.6 points compared to 51.3 in January.

Forex – there is a positive trend for the US dollar, against the Japanese yen is gaining 0.6%, the Euro weakened by 0.2% against the dollar.

Commodities – WTI crude oil is rising by 0.2% to a price level of 54.12 dollars per barrel.

The Gold retreated by 0.9% to a price level of 1243.30 dollars per ounce.

Trading Opportunity

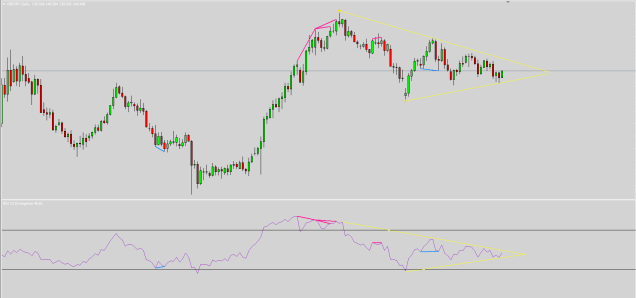

GBP/JPY

On a daily chart the pair is on a rising trend.

A triangle pattern is created, and the tendency is to look when the pair breaks the upper leg of the triangle.

A brake above the level of 142.00 could led us into a trade, to a long term expiry time.