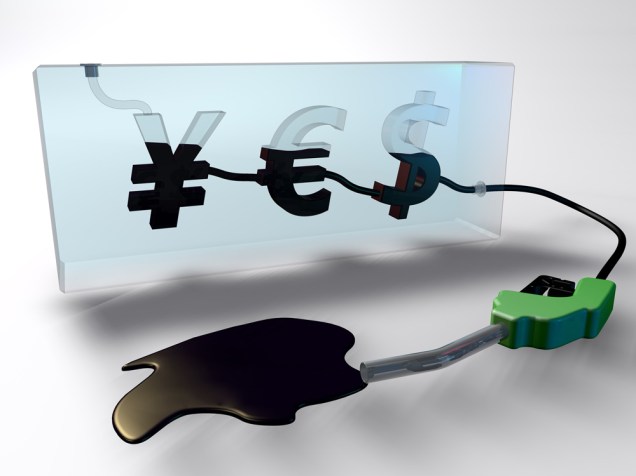

The Euro is now down by 0.4% against the US dollar and trading around 1.048 dollars per euro.

The Euro is now down by 0.4% against the US dollar and trading around 1.048 dollars per euro.

The US dollar enjoyed a positive trend.

He rises against the Japanese yen by 0.2% to 117.36 yen and against the British pound and the Euro going up by 0.1%.

The Italian parliament last night approved the establishment of a fund to rescue banks at a huge financial volume of 20 billion Euros.

The establishment of the fund will allow liquidity to the banking system and actually saves them from collapse.

This step was urgent in light of the fact that the third largest bank in Italy, the Banca Monte Dei Paschi is close to a situation of illiquidity bring closure.

It is estimated that the bank has sufficient liquid resources for just 11 months.

The Bank is required by the European regulation to raise 5 billion Euros by the end of the year, and given the situation it seems that he could not make it by free market funding and therefore will be forced to accept the Italian taxpayer money, or at least guarantees that will enable it to raise money at a later stage in markets.

The Euro falling to a low of 13 years against the US dollar and is trading around the 1.04 level.

According to reports, the Italian government is planning to invest 15 billion Euros to rescue several banks in the country.

The Euro is stable against the US dollar, to a rate of 1.076, after the publication of the growth figures in Europe.

The pound strengthened by 0.1% against the US dollar, to a rate of 1.275.

Europe – PMI Markit weighted for November stood at 54.1 points, the highest figure recorded in 2016, and significantly higher than economists’ forecasts of 53.3 points.

The rise of the US dollar ended yesterday.

Against the Euro it weakened by 0.4%.

Against the British pound the US dollar fell more than than 1.2%.

The recovery of the Euro zone economy is heavily dependent on incentives provided by the European Central Bank, said today the chairman of the bank, Mario Draghi.

These comments suggest that the bank may decide to increase the “quantitative easing” – ie bond purchases Bank , at the next meeting in December.

The trading on the European stock markets trading is now conducted on a negative trend, also because the weakening trend in the Euro, with the longest sequence of declines against the US dollar since introduced in 1999.

Even at the height of the European crisis, the Euro didn’t weakened for so many days in a row.