After a positive locking in New York over the weekend, today (Monday) the markets on Wall street opened the trading day with declines.

After a positive locking in New York over the weekend, today (Monday) the markets on Wall street opened the trading day with declines.

After it looks as if Greece’s economy starts to show signs of recovery, today the country’s statistics office released a data illustrating that the country is still stuck in deep mud.

The data indicate that the country’s economy shrank in the fourth quarter at a rate much faster than thought earlier.

In the fourth quarter, Greece’s economy shrank by 1.2% compared to the third quarter.

The general trend today in the European stocks is negative.

The FTSE decreasing by 0.3%, the CAC weakened by 0.4% and the DAX weakened by 0.4%.

The US employment report will be published on Friday.

Analysts’ forecasts are to an increase of 195 thousand persons in employment in February.

If the report data would be stable, as predicted by analysts, the chances of a US interest rate rise next week by the Federal Reserve will be higher.

Central banks of China and Europe will publish this week the interest rate decision for March.

China lowered its growth targets to the year of 2017 due to the continued slowdown in the world’s second largest economy and the government’s attempt to promote reforms that will protect the country from financial hazards.

The Prime Minister of China said that the country’s economy is expecting a grow of 6.5% this year.

The ECB is expected to leave interest rates unchanged.

The Bank will continue the policy of quantitative easing, it was announced by the Bank President Mario Draghi in December.

However, inflation in the Euro zone in February amounted to 2%, the target set by the bank while the underlying inflation in the Euro area remained unchanged for the third month in a row , 0.9%.

These figures present a challenge for the Bank in choosing the correct monetary stimulus.

Trading Opportunity

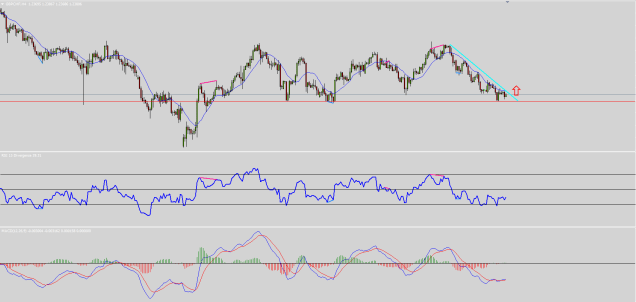

GBP/CHF

On 4 hours the pair is making his way to a support area, around the level of 1.2345.

An opportunity to enter with a CALL trade can get under way as long as the pair doesn’t brake down this support area, and after the pair will broke the diagonal resistance line, around the level of 1.2400.

Wall Street stock markets are expected to open on a negative trend today towards the speech of the Fed Chairman, Janet Yellen, where investors hope to get a final confirmation that the Fed will raise the interest rates at its meeting in less than two weeks.

The European stock markets trading is conducted price declines following the trend in Asia and New York.

The FTSE drops by 0.3%, the DAX loses 0.5%.

German retail sales fell unexpectedly by 0.8% in January compared to December, while the forecasts expected a small increase of 0.2%.

Wall Street’s stock markets recorded the sharpest daily fall this month following a decline in the banks and industry shares.

The S&P 500 retreated by 0.6%, the sharpest daily decline since January 30.

The Nasdaq Composite Index fell by 0.7%, the Dow Jones lost 0.5% but closed above the 21,000 level.

Snap shares soared yesterday by 44% on its first trading day on Wall Street.

On Wednesday snapchat app were issued at a value of $ 24 billion.

The inflation in Japan rose in January for the first time by more than a year at the backdrop of the government’s efforts and the country’s central bank to keep the economy from a state of deflation.

The CPI rose by 0.1% compared with January, 2016, after falling 0.2% in December.

The price increases resulted mainly from higher prices of oil and other commodities.

This morning the Asian stock markets trading is conducted with price declines following the trend on Wall Street tonight.

Tokyo drops 0.6%, Hong Kong lost 0.6%, Shanghai is weaker by 0.4% ,Singapore falls by 0.9%, Seoul lost 1.3%.

Trading Opportunity

EUR/GBP

An intraday opportunity.

On an hour chart the main trend is an up-trend.

At the moment there is a resistance line around the level of 0.8590.

If the pair will broke above the areas of 0.8590 – 0.8600, there will be a chance to enter for a CALL trades, with the main trend for short trades time frames.

U.S. Jobless Claims Lowest Since March 1973!

The number of Americans applying for unemployment benefits fell to the lowest level in 44 years last week, more evidence of a healthy labor market.

Initial jobless claims across the U.S. fell by 19,000 to a seasonally number of 223,000.

The markets on Wall street are expected to open today in stability.

Investor attention will be given as of the beginning of trading in shares of snapchat app, yesterday it was issued at a value of $ 24 billion.