In Asia today the trading ended with a negative trend in most of the leading stock exchanges, at the background of the falls in prices on Wall Street last night.

Yesterday, the London Stock Exchange shed 2.5% on the day after Prime Minister May announced that the elections would be held on June 8, and this morning the British stock exchange is down 0.2%.

This coming Sunday, another event is expected to shake Europe in particular and the financial markets in general – the first round of the French presidential elections.

The continued tension between the US and North Korea also does not add health to market players.

Trading Opportunity

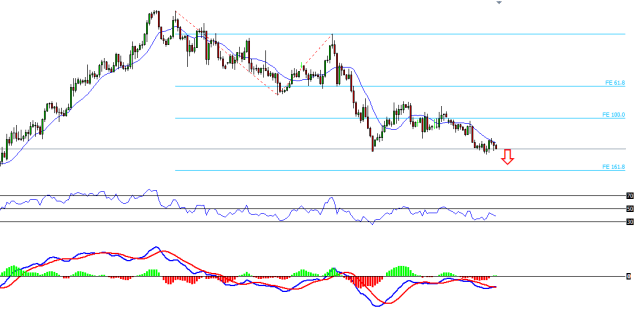

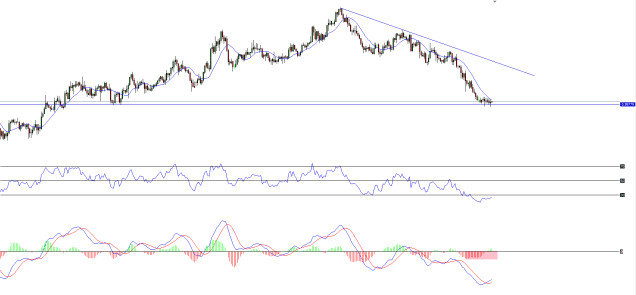

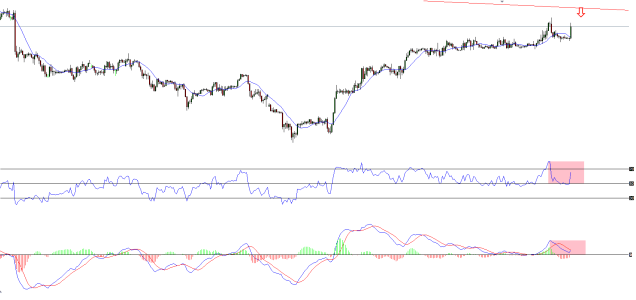

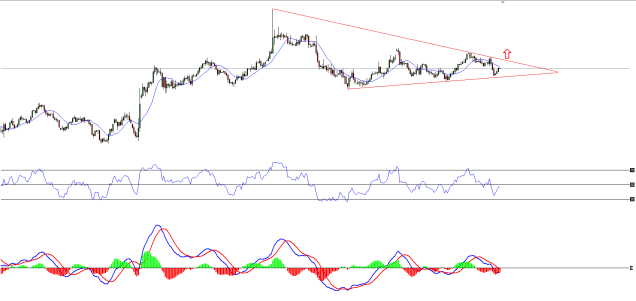

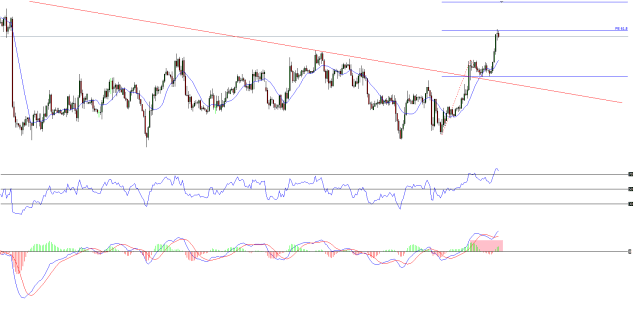

USD/JPY

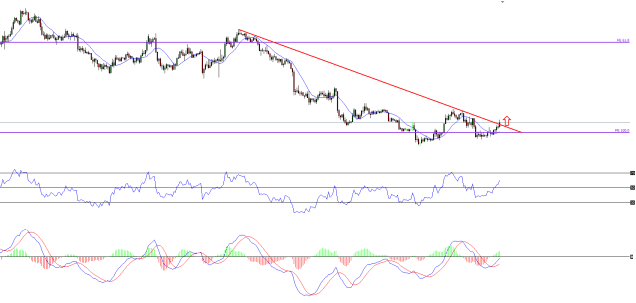

On the daily chart the pair reached the 100.0 level of the Fibonacci Extension (around 108.50) completing a double wave down.

There is a bullish divergence at MACD which can be a sign of the end of the trend.

What can we do from here?

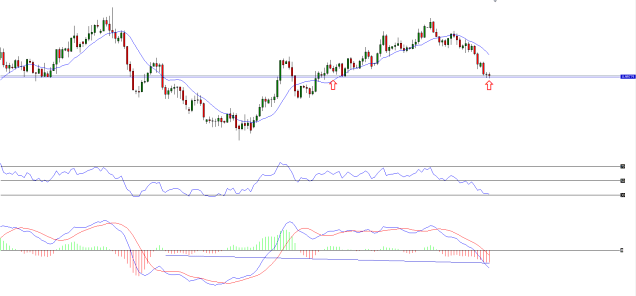

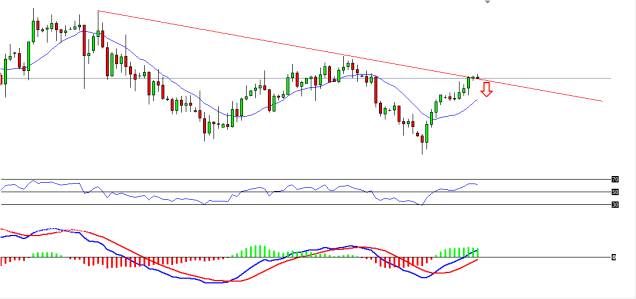

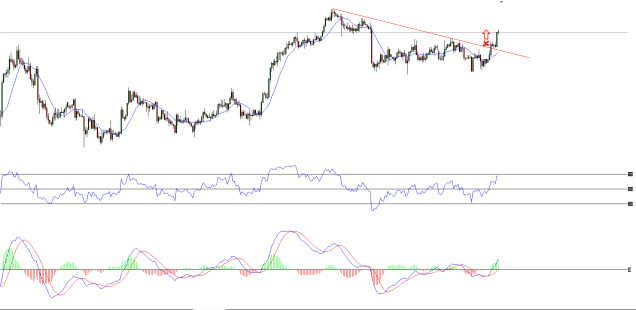

Our trigger for a buy CALL options would be in a lower time frame.

On an hour chart the pair broke above a downtrend line (108.80)

We can try and enter the trade from this point.